Navigating the Nuances of Gap Insurance: Your Financial Safeguard

Gap insurance plays a critical role in financial planning, especially for those financing or leasing vehicles. Essentially, it covers the "gap" between the vehicle's actual cash value and the amount still owed on it in the event of a total loss or theft. This type of insurance is particularly vital given the rapid depreciation of new vehicles, which can leave owners in a precarious financial position. It's a strategic layer of protection that ensures individuals aren't left with significant out-of-pocket expenses.

Unlocking the Benefits: A Deep Dive into GAP Insurance Advantages

When purchasing a new car, understanding the array of insurance options can be overwhelming. Guaranteed Asset Protection (GAP) insurance stands out as a critical safeguard for car owners. This specialized insurance covers the "gap" between your vehicle's actual cash value and the amount you owe on your loan or lease if your car is totaled or stolen. It's an essential layer of financial protection that can save you from paying out of pocket for a vehicle you no longer have.

Understanding the Importance of Gap Insurance for Your Vehicle

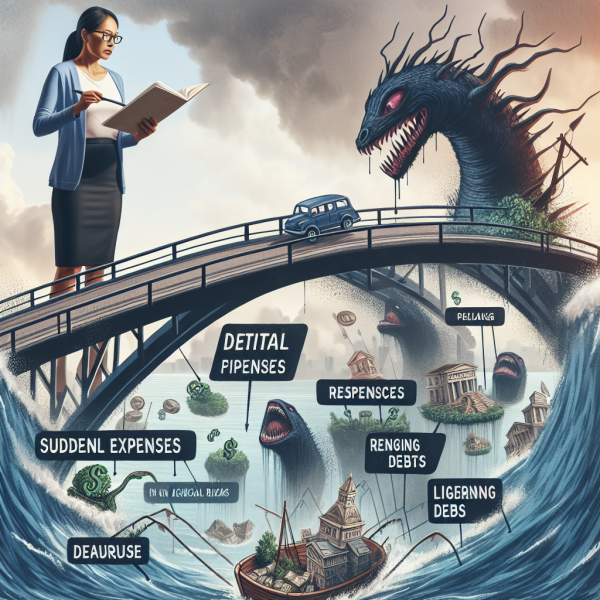

Gap insurance plays a pivotal role in protecting car owners from financial distress in the event their vehicle is totaled or stolen and not recovered. It covers the difference between the vehicle's actual cash value (ACV) and the amount you owe on your loan or lease. This type of insurance is particularly valuable during the early years of car ownership, when depreciation can significantly reduce a vehicle’s market value. Understanding gap insurance and its relation to vehicle value is crucial for making informed decisions about your car insurance needs.

Understanding GAP Insurance: The Key to Protecting Your Loan and Lease Investments

GAP Insurance, an acronym for Guaranteed Asset Protection, plays a crucial role in safeguarding your vehicle's financing or leasing agreements. This coverage is designed to pay the difference between the actual cash value of your vehicle and the remaining balance on your loan or lease in the event of a total loss. It's particularly vital during the initial years of new car ownership, where depreciation can outpace loan repayment, leaving a financial "gap" if the car is totaled. Keeping abreast of the essentials of GAP insurance ensures that you're fully protected against unforeseeable losses.

Understanding the Basics of Gap Insurance

Gap insurance is a type of car insurance coverage designed to pay the difference between the actual cash value of a vehicle and the amount still owed on its financing or lease in the event of a total loss. It's a crucial safeguard for those leasing or purchasing a new car with a small down payment, ensuring financial protection against depreciation. This insurance is particularly important given the rapid depreciation of new vehicles within the first few years of purchase. Understanding gap insurance can save car owners from unexpected financial strain in unfortunate situations like theft or total loss in accidents.