Navigating the Nuances of Gap Insurance: Your Financial Safeguard

Posted on: Saturday, March 2nd, 2024

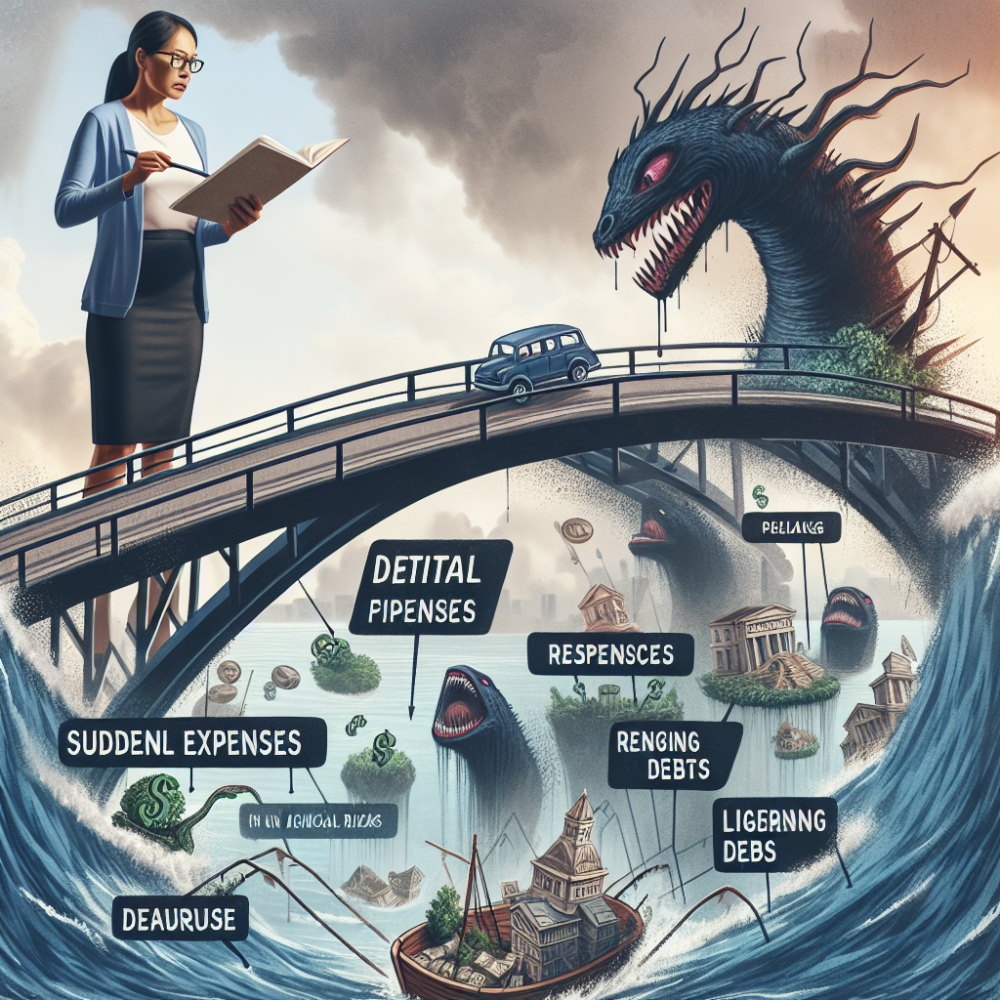

Gap insurance plays a critical role in financial planning, especially for those financing or leasing vehicles. Essentially, it covers the "gap" between the vehicle's actual cash value and the amount still owed on it in the event of a total loss or theft. This type of insurance is particularly vital given the rapid depreciation of new vehicles, which can leave owners in a precarious financial position. It's a strategic layer of protection that ensures individuals aren't left with significant out-of-pocket expenses.

Gap insurance is not just an optional extra; for many, it's a necessary financial safeguard. When you finance or lease a vehicle, its depreciation begins immediately. Within just a few months, the vehicle's market value can dip substantially below the purchase price. If an accident were to occur leading to a total loss, traditional auto insurance would only cover the vehicle's current market value, not the total amount you owe on your loan or lease.

Many people are unaware that gap insurance can be purchased from sources other than dealerships, often at a considerably lower cost. Insurance companies, online providers, and even some financial institutions offer this coverage. It's key to shop around and compare prices and policies to ensure you're not only getting a good deal but also comprehensive protection that suits your financial situation and vehicle financing details.

It's also essential to understand when gap insurance is no longer needed. As you make payments on your vehicle, and its value stabilizes, you may find that the "gap" has closed, making the insurance unnecessary. Periodic reviews of your financial situation, loan balance, and car's actual value will help you determine the right time to cancel the policy and save money on premiums.

Not all gap insurance policies are created equal. Some offer coverage for deductible amounts, while others might exclude certain types of damage or incidents. Before purchasing a policy, it is crucial to read the fine print, understand the exclusions, limitations, and the claims process. Choosing the right policy involves balancing cost with the scope of coverage, ensuring it fits seamlessly into your financial safety net.

In conclusion, gap insurance is more than just an add-on to your auto insurance policy—it's a strategic tool for managing financial risk. Whether you're buying a new car, a used one, or leasing a vehicle, considering gap insurance is a smart financial move. By understanding what it covers, shopping around for the best rate, knowing when to drop the coverage, and what the policy includes, you can protect yourself against potential financial pitfalls. Remember, the key to financial security is not just in earning but in smart planning and protecting what you have.