Navigating the Future: A Guide to Self-Driving Car Insurance

Posted on: Saturday, March 2nd, 2024

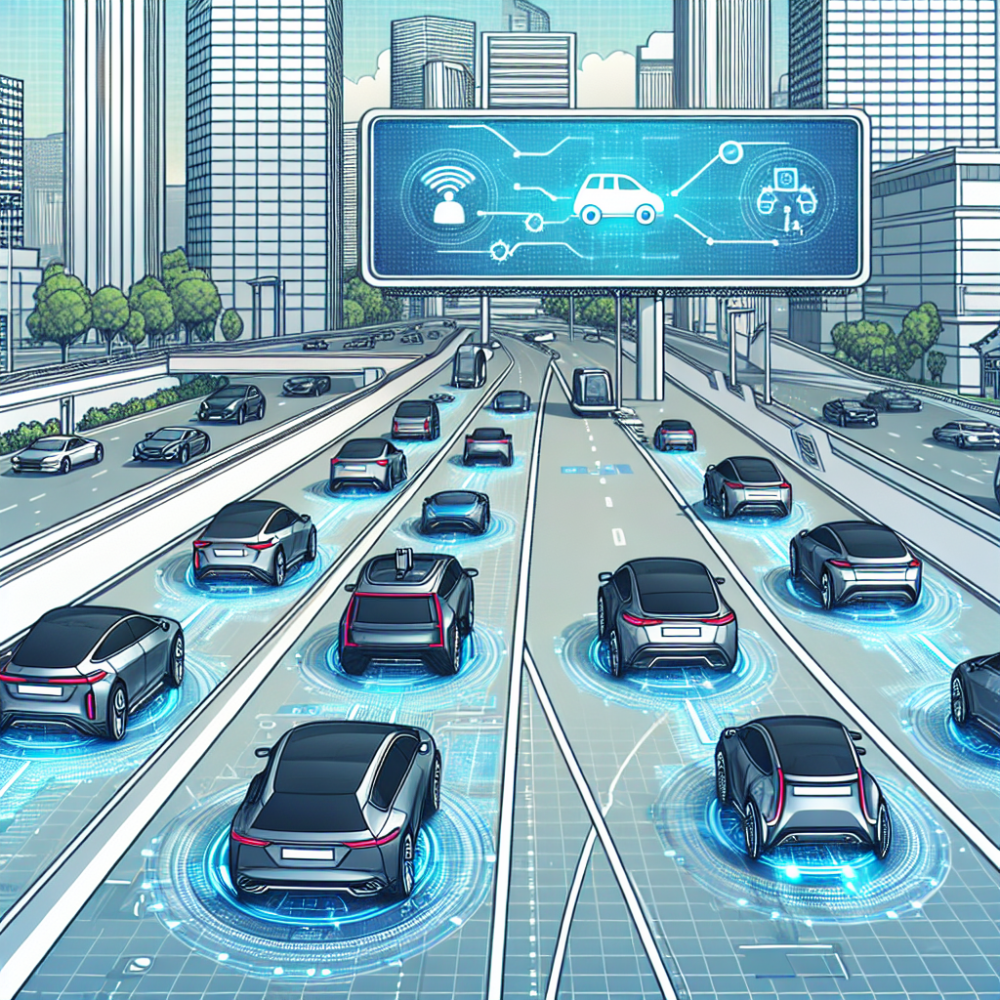

The evolution of self-driving cars, or autonomous vehicles, is reshaping the landscape of personal transportation and the insurance industry alike. As these innovative vehicles transition from testing labs to public roads, understanding the nuances of insuring them becomes paramount. This guide aims to explore the top considerations and emerging policies surrounding insurance coverage for autonomous vehicles. It seeks to provide clarity amidst the complexities of this rapidly changing domain.

At the forefront of the autonomous vehicle coverage conversation is the question of liability in the event of an accident. Traditional auto insurance policies are primarily built around the concept of human error. However, with self-driving cars, the liability may shift from the driver to the vehicle's manufacturer or the software developer, depending on the circumstances. This fundamental shift necessitates a reevaluation of policy structures and liability clauses.

Another critical aspect to consider is the categorization of autonomous vehicles for insurance purposes. The National Highway Traffic Safety Administration (NHTSA) defines several levels of automation, from level 0 (no automation) to level 5 (full automation). Insurance premiums could vary significantly based on the vehicle's level of autonomy, as higher levels of automation might reduce the risk of human error but introduce new risks related to software or hardware failures.

Pricing models for insuring autonomous vehicles may also undergo significant changes. The traditional metrics for determining insurance premiums, such as driving history, could become less relevant, while factors like the technological reliability of the vehicle's autonomous systems and the safety record of the vehicle's manufacturer might play a more prominent role. Additionally, the integration of telematics, which allows for the monitoring of the vehicle's condition and performance, might help in the more accurate assessment of risk.

Cybersecurity concerns represent another unique insurance consideration for autonomous vehicles. As these vehicles rely heavily on software and are connected to the internet, they are susceptible to hacking and other cyber threats. Insurance policies may need to include coverage for damages resulting from cyber-attacks, further complicating the assessment of risk and determination of premiums.

Regulatory frameworks play a crucial role in shaping the insurance landscape for autonomous vehicles. As governments and international bodies develop and implement regulations concerning the testing and operation of self-driving cars, insurance providers must adapt their policies to comply with these evolving standards. This includes staying abreast of changes in liability laws and the potential for mandated minimum coverage levels.

In conclusion, the advent of autonomous vehicles presents both challenges and opportunities for the insurance industry. Insurers must navigate the complexities of new technologies, evolving legal landscapes, and changing risk profiles. As we inch closer to a future dominated by self-driving cars, both insurers and insureds must foster a deep understanding of these issues to ensure adequate and fair coverage in the event of an accident.