Understanding the Core of Auto Insurace Premium Calculation

Auto insurance companies employ complex algorithms to determine the premium rates for individuals, a process known as risk assessment. These algorithms analyze a vast array of personal and external factors to predict the likelihood of an insurance claim being filed. Modern advancements in data analysis and predictive modeling have significantly refined these assessments, making them more accurate than ever. Understanding these factors can empower consumers to make informed decisions about their auto insurance and potentially lower their rates.

Understanding the Mechanics Behind Your Car Insurance Premiums

Car insurance rates are calculated through complex algorithms that take into account a myriad of factors. These algorithms analyze extensive data sets to predict the risk associated with insuring an individual driver, directly impacting the premium rates. The dynamic nature of data and evolving statistical models mean that these algorithms are continuously updated for precision. This guide aims to shed light on some of the critical data points and analysis methods used in shaping car insurance premiums.

Decoding Car Insurance Pricing: A Guide to Premium Calculations

Navigating the world of car insurance premiums can feel like trying to solve a complex equation. Behind every quote is a sophisticated algorithm that insurers use to determine how much you pay. These algorithms take into account a wide range of factors, from the obvious, such as your driving history and the type of car you drive, to the less apparent, like your credit score and even where you live. Understanding these factors can empower consumers to make informed decisions and potentially lower their insurance costs.

Understanding the Dynamics of Car Insurance Premiums

The intricacies of calculating car insurance rates are both complex and fascinating. At their core, these algorithms consider a multitude of diverse factors ranging from personal driving history to broader statistical data. This guide delves into the primary criteria that insurance companies use to determine your premium, shedding light on how each element plays a crucial role in the calculation. As the insurance landscape evolves with technology, staying informed on these factors can help you navigate the best rates possible.

Decoding the Mechanics Behind Your Car Insurance Premiums

In the current landscape of car insurance, sophisticated algorithms play a pivotal role in determining the rate you pay. These algorithms take into account a multitude of factors, from driving history to personal demographics, to accurately assess risk and set premiums accordingly. Technological advancements and data analytics have significantly refined these processes, making them more intricate than ever before. Understanding the core elements these algorithms evaluate can empower consumers to make informed decisions about their car insurance.

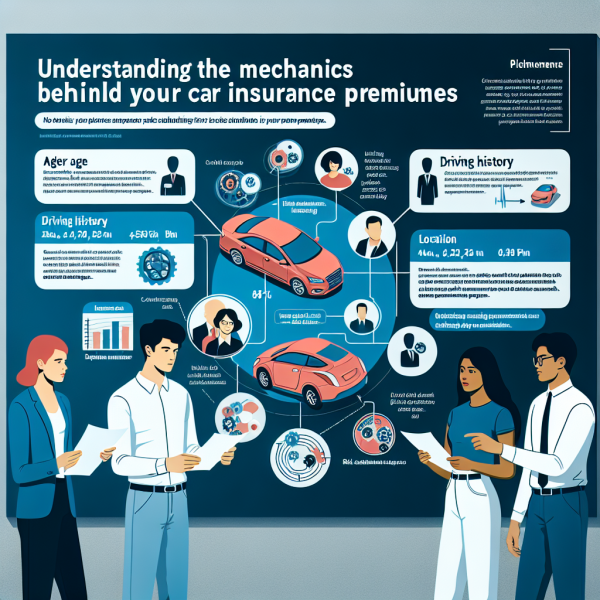

Understanding the Mechanics Behind Your Car Insurance Premiums

Car insurance companies rely on sophisticated algorithms to determine the rates they offer to consumers. These algorithms assess a wide variety of risk factors associated with individual drivers, their vehicles, and overall driving patterns. This method of risk assessment helps insurance providers to accurately predict the likelihood of a claim being made, allowing them to appropriately price their insurance products. Understanding these factors can empower consumers to take actionable steps to lower their premiums.

Deciphering the Math Behind Auto Insurance Premiums

Understanding the intricate algorithms behind car insurance rates can seem daunting, but it's crucial for both consumers and professionals in the industry. These algorithms are sophisticated models that analyze a vast array of data points to determine individual premium rates. Recent advancements in data analysis and machine learning have significantly influenced these models, making them more accurate than ever before. This guide aims to shed light on the top ten factors these algorithms evaluate, providing insight into how your car insurance rates are determined.

Understanding the Mechanics Behind Your Auto Insurance Rates

Car insurance rates are not randomly assigned; rather, they are determined through complex algorithms that take into account a host of variables. These algorithms evaluate risk factors associated with individual drivers, their vehicles, and even their geographical locations. By understanding these underlying factors, drivers can gain insights into how their rates are calculated and explore strategies for reducing their premiums. This guide will delve into the top 10 elements that significantly influence insurance rate calculations, shedding light on the often opaque process of premium determination.

The Insider's Guide to Understanding Car Insurance Pricing

Car insurance rates are a complex puzzle that insurers solve using a variety of data points and algorithms. At its core, the calculation of your insurance premium is designed to assess the risk you pose as a driver and the likelihood of you filing a claim. Modern insurers use sophisticated algorithms that take into account not just your driving history but an array of other factors as well. Understanding these elements can help you navigate the often-confusing world of insurance pricing and potentially save you money.

Mastering the Matrix: Understanding the Mechanics Behind Your Car Insurance Rates

Navigating through the landscape of car insurance rates can often feel like trying to decipher a complex algorithm. Indeed, at the heart of every insurance quote is a sophisticated system designed to assess risk and calculate premiums accordingly. These algorithms take into account a myriad of factors, from personal driving history to broader statistical data on vehicle safety. Understanding the key components that influence these algorithms can empower consumers to make informed decisions, potentially leading to more favorable insurance rates.